The IRS has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation. Here's what you need to know now.

Read More

This great video from our partners at Eaton Vance explains what tax-loss harvesting is, and how it works.

Read More

Taxes are one of the biggest budget items for most taxpayers, yet many have no idea what they’re getting for their money.

Read More

Do you still need to fill out taxes if a family member passes away? Read more to find out!

Read More

Does your budget need any adjustments?

Read More

Have you ever wondered what different forms you need and what they all mean? Read more to find out!

Read More

Do you know the difference between long-term and short-term capital gains and their tax implications?

Read More

Discover how you can exchange annuity contracts or life insurance policies with great flexibility and potential benefits.

Read More

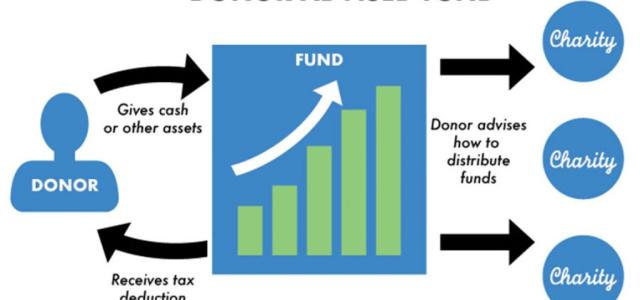

The holiday season offers an opportunity to potentially reduce your taxes while supporting causes close to your heart.

Read More

Take action before December 31 to maximize your tax advantages for the next year.

Read More

Discover how your tax liability may change and what are the best strategies to navigate the widow tax.

Read More

Higher earners who maximize retirement savings now have more time for pretax catch-up 401(k) contributions, thanks to new IRS guidance.

Read More